[YEAH SORRY THIS IS MOSTLY INFORMATION FOR MYSELF BUT HEY IF YOU'RE IN AUSTRALIA AND WANT A HOUSE THEN TAKE A LOOK AT THIS YO]

It's time to tighten up negative gearing

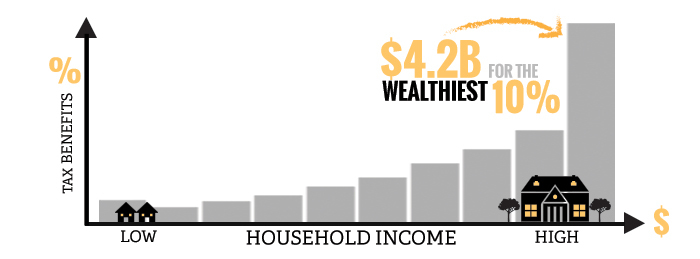

Negative Gearing costs the government billions ever year; it reduces homeownership; and it increases inequality. In fact, The Australia Institute's report – fully funded by GetUp members – shows that $4.2B in negative gearing tax breaks go to the top 10% of income earners.

There's growing consensus that it's time to reform negative gearing – from the Chief Economist at Bank of America Merrill Lynch to the Australian Council of Social Services. And it's not hard to see why: in one fell swoop we could have a fairer budget that saves the bottom line billions and makes housing more affordable.

We need a Brighter Budget that gets rid of unnecessary, wasteful handouts for the wealthy. Will you sign on to join the Brighter Budget campaign and help champion smart, fair solutions for this year's Budget – such as negative gearing reform?

There's growing consensus that it's time to reform negative gearing – from the Chief Economist at Bank of America Merrill Lynch to the Australian Council of Social Services. And it's not hard to see why: in one fell swoop we could have a fairer budget that saves the bottom line billions and makes housing more affordable.

We need a Brighter Budget that gets rid of unnecessary, wasteful handouts for the wealthy. Will you sign on to join the Brighter Budget campaign and help champion smart, fair solutions for this year's Budget – such as negative gearing reform?

Negative gearing operates as a tax break for investors. For property investors, this means using their rental property costs to reduce their taxable income. (E.g. If the costs-associated with your property are higher than the earnings from your poperty (rent), you can use that loss to pay less income tax.)

It may seem complicated, but it's very simple when it comes to who wins and who loses.

The winners are the wealthiest 10 per cent of income earners who receive the vast majority of the tax break.

The losers are the low income earners, who are shut out of an already hot housing market, with negative gearing fanning the flames.

But in the end, all Australians lose. With negative gearing, the government is wasting potential revenue on wasteful tax breaks for the wealthy. This money could instead be spent on services we all need, like better schools and hospitals.

It's also important to remember that Australia is one of the few countries to allow negative gearing losses to directly offset your taxable income. It is far more restricted in Britian, and even the United States.

It may seem complicated, but it's very simple when it comes to who wins and who loses.

The winners are the wealthiest 10 per cent of income earners who receive the vast majority of the tax break.

The losers are the low income earners, who are shut out of an already hot housing market, with negative gearing fanning the flames.

But in the end, all Australians lose. With negative gearing, the government is wasting potential revenue on wasteful tax breaks for the wealthy. This money could instead be spent on services we all need, like better schools and hospitals.

It's also important to remember that Australia is one of the few countries to allow negative gearing losses to directly offset your taxable income. It is far more restricted in Britian, and even the United States.

One possible solution is to reform negative gearing so that it applies to new construction only – this is the crux of the Australia Institute's report. Doing so would create more of an incentive to invest in new housing, therefore increasing supply and driving down prices and rent.

Click here to read the full policy report: http://www.tai.org.au/content/top-gears

Click here to read the full policy report: http://www.tai.org.au/content/top-gears

The Government and the Labor opposition are looking for ways to save money in the Budget — so GetUp members are getting on the front foot to ensure these savings are fair and sustainable over the long-term. Instead of the austerity cuts that attack everyday Australians, we're campaigning for a Brighter Budget this time around.

Here are the policies we're launching as part of our Brighter Budget campaign:

Here are the policies we're launching as part of our Brighter Budget campaign:

- Reform negative gearing. Restrict tax concessions for negative gearing so they only apply to new housing stock. Australia is one of the few countries to allow negative-gearing losses to be offset against income – and no wonder given that fifty percent of this tax break goes to the top two percent of income earners. Reforming negative gearing will encourage investment in new housing stock, put downward pressure on rent and make housing more affordable.

- Reform superannuation tax concessions. Instead of giving all the tax breaks to those at the top, give the bigger concessions to those who need them most, and in the process ensure everyone can save for their retirement. Click here to sign the petition.

- Introduce the 'Buffett Rule'. Thanks to tax loopholes and high priced accountants, Kerry Packer famously reduced his effective tax rate so he paid less tax than his gardener. 'The Buffett Rule' would put a cap on loopholes for the top 1% of income-earners to ensure they pay at least the same tax rate as middle-income Australians. Click here to sign the petition.

- Scrap the capital gains tax discount. Concessions on capital gains tax predominantly benefit the wealthy, who have a larger proportion of their income from investments. Getting rid of the discount could save about $4 billion.

- Cut fossil fuel subsidies. Right now, the government hands over $11.5 billion a year in industry subsidies that incentivise pollution. We need to cut industry subsidies that aren't actually helping to create jobs and are just giving a hand out to multi-million dollar companies whose profits go overseas.

- Impose a super profits tax on banks. The big banks make inflated profits thanks to a lack of competition. A tax on those super profits would help compensate Australians for higher fees and charges.

- Introduce a 'Tobin Tax' on high frequency financial transactions. Big investment banks use powerful computers to trade in the financial market at huge volumes. This high frequency trading pushes up share prices for normal mum and dad investors. A tax of less than half a percent on these big investment banks' transactions would improve market stability and raise over $1 billion a year.

- Place a duty on wealthy estates. Place an inheritance tax on large estates.

No comments:

Post a Comment